Tech

Top Canadian High Growth Tech Stocks to Watch

The Canadian market has been closely watching the U.S. Federal Reserve’s annual symposium in Jackson Hole, Wyoming, as investors anticipate potential rate cuts that could influence economic conditions and market sentiment. In this environment of heightened attention to monetary policy, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on opportunities within the dynamic Canadian tech sector.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Stingray Group | 4.94% | 69.22% | ★★★★☆☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

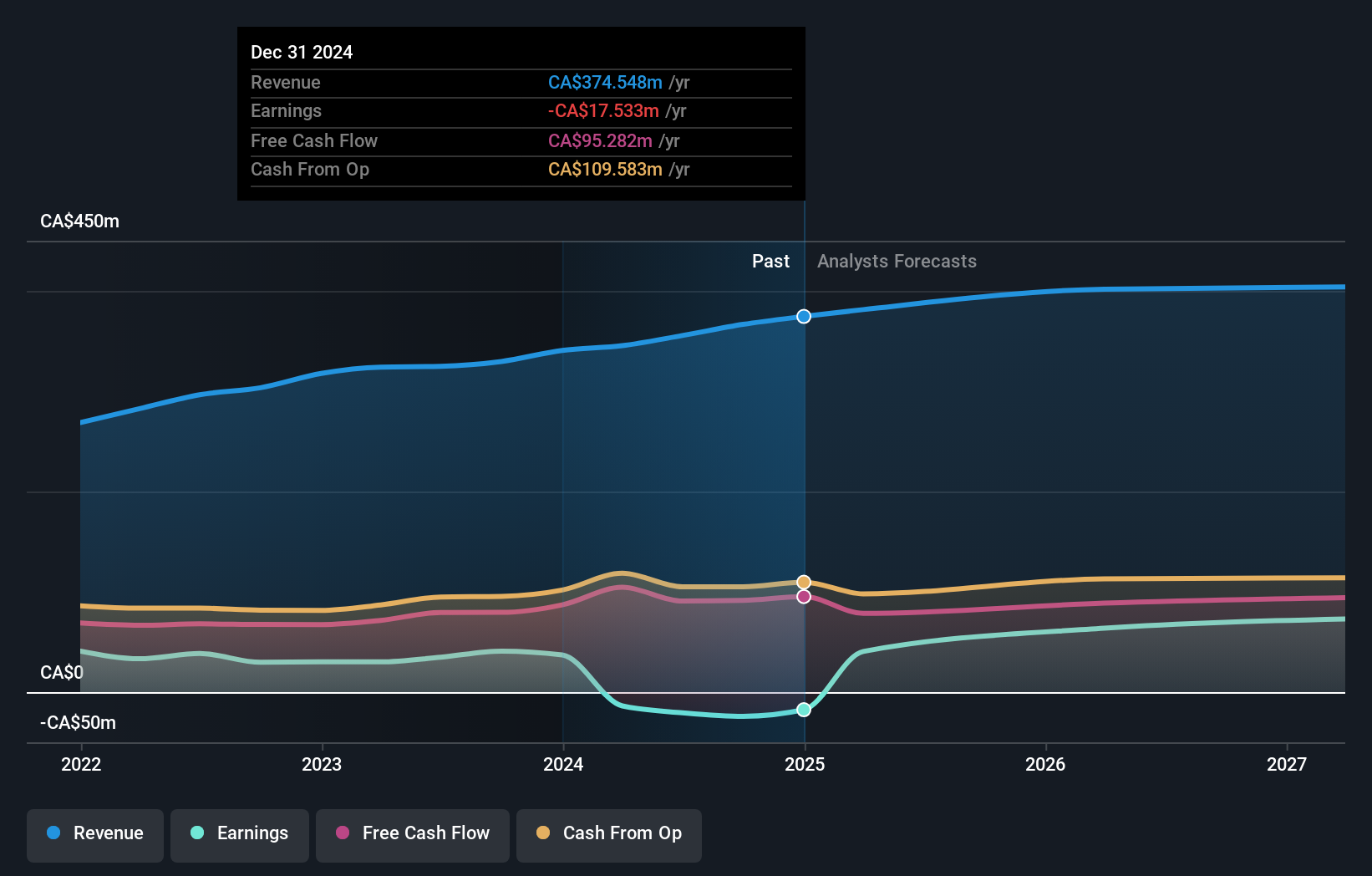

Overview: Cineplex Inc., together with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$678.24 million.

Operations: Cineplex generates revenue primarily from three segments: Media (CA$120.16 million), Location-Based Entertainment (CA$132.08 million), and Film Entertainment and Content (CA$1.05 billion).

Cineplex, a prominent player in Canada’s entertainment sector, showcases an intriguing blend of challenges and opportunities. Despite reporting a net loss of CAD 21.44 million for Q2 2024, the company is expected to see revenue growth at 8.1% annually, outpacing the Canadian market’s 7%. With earnings forecasted to grow by an impressive 179.27% per year over the next three years and a share repurchase program targeting up to 6.32 million shares, Cineplex demonstrates strategic initiatives aimed at long-term recovery and growth within the tech-driven entertainment landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company specializing in the development and licensing of reservoir simulation and seismic interpretation software, with a market cap of CA$1.00 billion.

Operations: The company generates revenue primarily from the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. It also provides related consulting services.

Computer Modelling Group (CMG) showcases a promising trajectory in the tech sector with its forecasted earnings growth of 24.6% per year, outpacing the Canadian market’s 15.5%. The company’s recent revenue increase to CAD 30.52 million from CAD 20.75 million highlights robust performance despite a dip in net income to CAD 3.96 million from CAD 6.9 million last year, reflecting strategic investments and R&D expenses totaling $11M annually for innovative solutions like CO2LINK in carbon capture and storage projects with clients such as Sval Energi AS, which could bolster long-term growth prospects significantly.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$547.36 million.

Operations: Stingray Group Inc. generates revenue primarily from its Radio segment (CA$154.41 million) and Broadcasting and Commercial Music segment (CA$201.10 million). The company operates globally, focusing on music, media, and technology services.

Stingray Group’s recent moves, including the launch of FAST channels on The Roku Channel and a strategic partnership with Samsung VXT, highlight its innovative approach to expanding digital content offerings. Despite a 4.9% annual revenue growth forecast, slower than the Canadian market’s 7%, Stingray is expected to see earnings grow by 69.22% annually over the next three years. With R&D expenses contributing significantly to its portfolio expansion, Stingray reported CAD 89.07 million in sales for Q1 2024 but saw net income dip to CAD 7.3 million from CAD 14.12 million last year due to strategic investments and operational costs.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com