Tech

High Growth Canadian Tech Stocks To Watch This September 2024

With the Fed kicking off a rate-cutting cycle and the Bank of Canada signaling potential further cuts, the economic landscape is shifting in ways that could benefit high-growth tech stocks. In this environment, identifying companies with strong fundamentals and innovative capabilities becomes crucial for investors looking to capitalize on these market dynamics.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.38% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Cineplex | 7.33% | 179.27% | ★★★★☆☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$92.72 billion.

Operations: Constellation Software Inc. generates revenue primarily from its Software & Programming segment, which accounted for CA$9.27 billion. The company focuses on acquiring and managing vertical market software businesses internationally.

Constellation Software demonstrates robust growth with a 33.5% increase in earnings over the past year, surpassing the software industry’s average of 1.9%. This performance is bolstered by significant R&D investment, aligning with its strategic focus on innovation and market expansion. Recent financials reveal a jump in revenue to $2.47 billion in Q2 2024 from $2.04 billion the previous year, reflecting a solid execution of its growth strategies amidst competitive pressures. Additionally, the launch of Omegro underlines Constellation’s commitment to diversifying its portfolio and enhancing global reach, promising continued upward trajectory in operational efficiency and market penetration.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company that provides an artificial intelligence (AI)-powered learning platform in North America and internationally, with a market cap of CA$1.91 billion.

Operations: The company generates revenue primarily from its educational software segment, which brought in $200.24 million. Its AI-powered learning platform is offered across North America and internationally.

Docebo’s recent surge in earnings by 130.2% over the past year, significantly outpacing the software industry’s growth of 1.9%, underscores its robust position in high-growth tech sectors. This performance is complemented by a strategic emphasis on R&D, with expenses aligned to foster innovations that meet evolving learning needs. The company’s revenue is also on an upward trajectory, expected to grow annually by 14.7%, faster than the Canadian market average of 6.9%. With new leadership under CEO Alessio Artuffo and a clear focus on expanding its technological offerings, Docebo is poised to maintain its momentum amidst competitive pressures and shifting market demands.

Simply Wall St Growth Rating: ★★★★☆☆

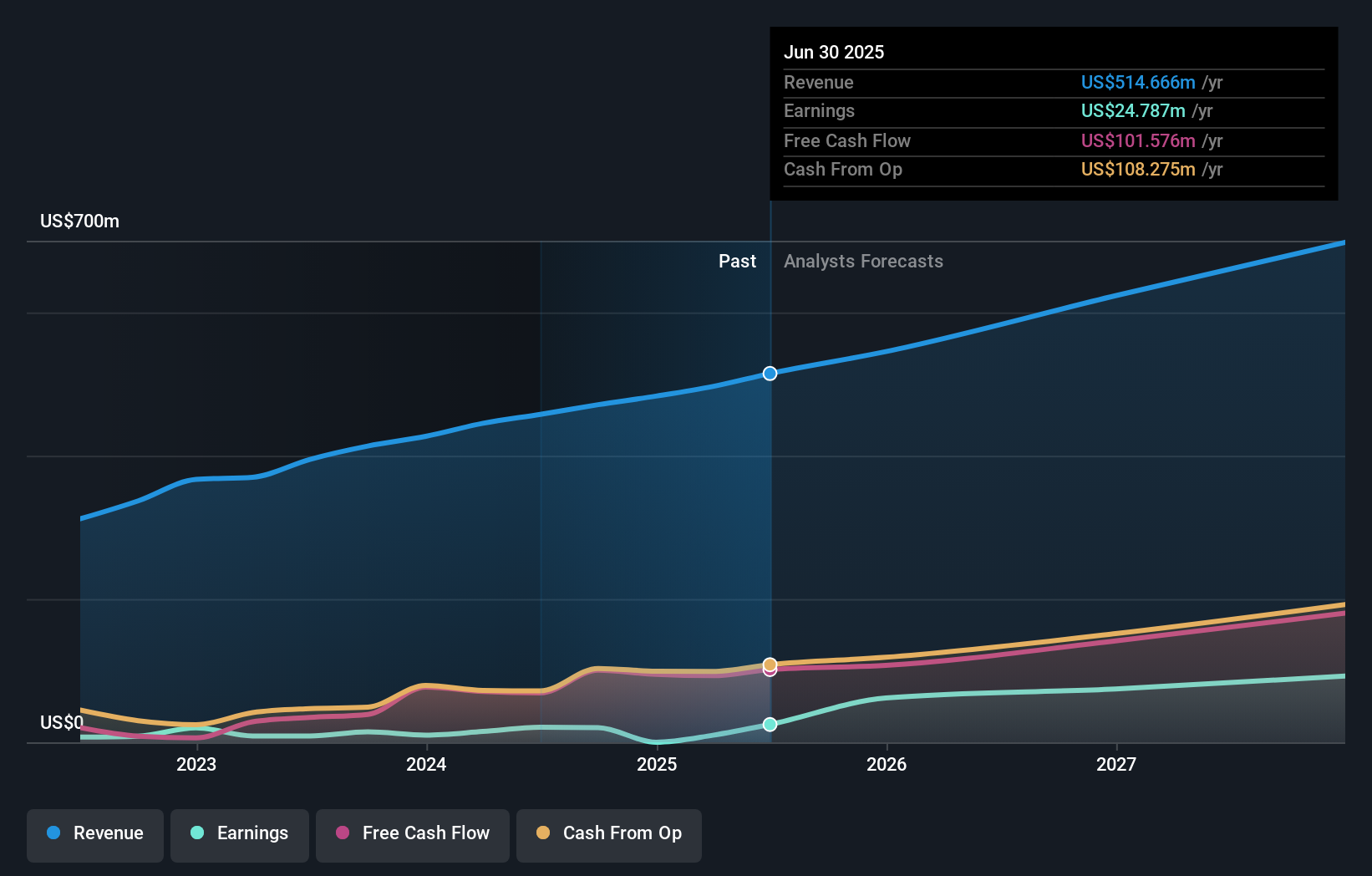

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.59 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software for supply chain operations, amounting to $457.72 million from the Software & Programming segment. The company operates across multiple regions including the United States, Europe, Asia, and Canada.

Amidst a backdrop of investor activism and executive changes, Kinaxis stands out with its robust focus on R&D, dedicating 14.9% of its revenue to innovation—a strategy that bolsters its competitive edge in the $16 billion supply chain management software market. This investment is pivotal as the company navigates through leadership transitions and strategic reviews suggested by stakeholders like Irenic Capital Management. Despite these challenges, Kinaxis’ recent performance reveals a promising trajectory with earnings forecasted to surge by 48.9% annually, underscoring its potential resilience and adaptability in a dynamic industry landscape.

Next Steps

- Unlock our comprehensive list of 23 TSX High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com