Tech

High Growth Canadian Tech Stocks to Watch in September 2024

As the Canadian TSX has experienced a modest decline of about 3% amid broader market volatility and softening labor markets in both the U.S. and Canada, investors are keenly watching how central bank policies might shift in response to these economic signals. In this environment, identifying high-growth tech stocks that can navigate these uncertainties becomes crucial for long-term portfolio resilience.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.70% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.54% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.33% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally; it has a market cap of CA$90.38 billion.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, which accounts for CA$9.27 billion. The company focuses on acquiring and managing vertical market software businesses globally.

Constellation Software reported a notable revenue increase to $2.47 billion in Q2 2024, up from $2.04 billion the previous year, showcasing its robust financial health. The launch of Omegro, encompassing over 30 business units and serving more than 15,000 customers globally, underscores its strategic expansion in diverse software applications like ERP and CRM. With R&D expenses contributing significantly to innovation and growth, Constellation’s earnings are forecasted to grow at an impressive annual rate of 23.6%, surpassing the Canadian market average of 15.1%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across various regions including the United States, Europe, Asia, and Canada, with a market cap of CA$4.26 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software for supply chain operations, with the Software & Programming segment contributing $457.72 million. The company operates in multiple regions, including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in supply chain management software, is forecasted to grow earnings by 47.31% annually over the next few years, significantly outpacing the Canadian market average of 15.1%. Despite recent executive changes and investor activism urging a sale process, Kinaxis continues to innovate with its AI-infused Maestro platform. The company has repurchased 858,000 shares for CAD 109.18 million this year and reported R&D expenses at $58 million in Q2 2024, emphasizing its commitment to technological advancement and market leadership.

Simply Wall St Growth Rating: ★★★★☆☆

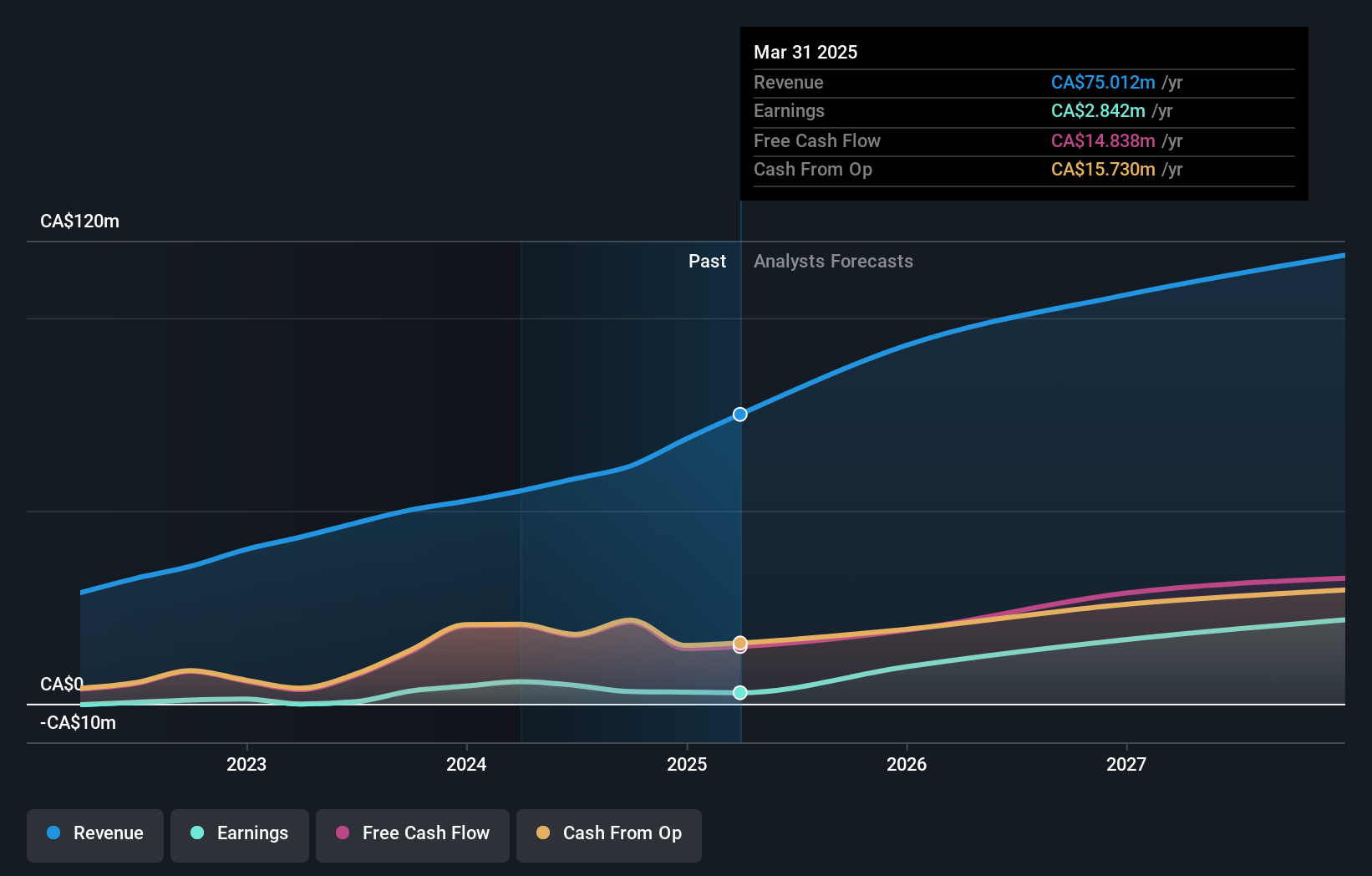

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally; it has a market cap of CA$422.08 million.

Operations: Vitalhub Corp. generates revenue primarily through its healthcare software segment, which contributed CA$58.32 million. The company operates across multiple regions including Canada, the United States, the United Kingdom, Australia, and Western Asia.

Vitalhub’s earnings surged by 877.1% over the past year, outpacing the Healthcare Services industry’s 24.5%. Despite a net loss of CAD 0.34 million in Q2 2024, revenue grew to CAD 16.24 million from CAD 13.09 million a year ago, reflecting strong operational performance. The company forecasts annual earnings growth of 65.9%, significantly higher than the Canadian market’s average of 15.1%. With R&D expenses at $3 million for H1-2024, Vitalhub emphasizes innovation in its healthcare software solutions.

Taking Advantage

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com