Tech

Exploring Constellation Software And 2 Other High Growth Canadian Tech Stocks

In recent weeks, the Canadian market has been closely monitoring the U.S. Federal Reserve’s annual symposium in Jackson Hole, Wyoming, where discussions around potential rate cuts have kept investors on edge. As markets await clearer signals from monetary policymakers, identifying high-growth opportunities becomes crucial for navigating these uncertain times. In this article, we explore Constellation Software and two other promising high-growth Canadian tech stocks that could offer significant potential amidst evolving economic conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| Wishpond Technologies | 12.72% | 113.87% | ★★★★☆☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$91.58 billion.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, amounting to CA$9.27 billion. The company focuses on acquiring, building, and managing vertical market software businesses globally.

Constellation Software’s earnings surged by 33.5% over the past year, outpacing the software industry’s 1.9% growth. Revenue is forecast to grow at 16.2% annually, faster than the Canadian market’s 7%. Their R&D expenses reflect a strategic focus on innovation, with $2.47 billion in revenue for Q2 2024 and net income rising to $177 million from $103 million a year ago, underscoring robust financial health and strong future prospects in tech solutions across diverse sectors.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company that provides an AI-powered learning platform in North America and internationally, with a market cap of CA$1.82 billion.

Operations: Docebo generates revenue primarily from its AI-powered educational software, amounting to $200.24 million. The company focuses on providing advanced learning management solutions across North America and international markets.

Docebo’s recent performance highlights its strong growth trajectory in the tech sector. For Q2 2024, sales surged to $53.05M from $43.59M a year ago, while net income swung to $4.7M from a net loss of $5.67M previously. The company’s R&D expenses underscore its commitment to innovation, with substantial investments driving future capabilities and product enhancements. Forecasted annual earnings growth at 34.1% and revenue expansion at 14.7% per year outpace the broader Canadian market trends, signaling robust prospects ahead for Docebo in the SaaS landscape.

Simply Wall St Growth Rating: ★★★★☆☆

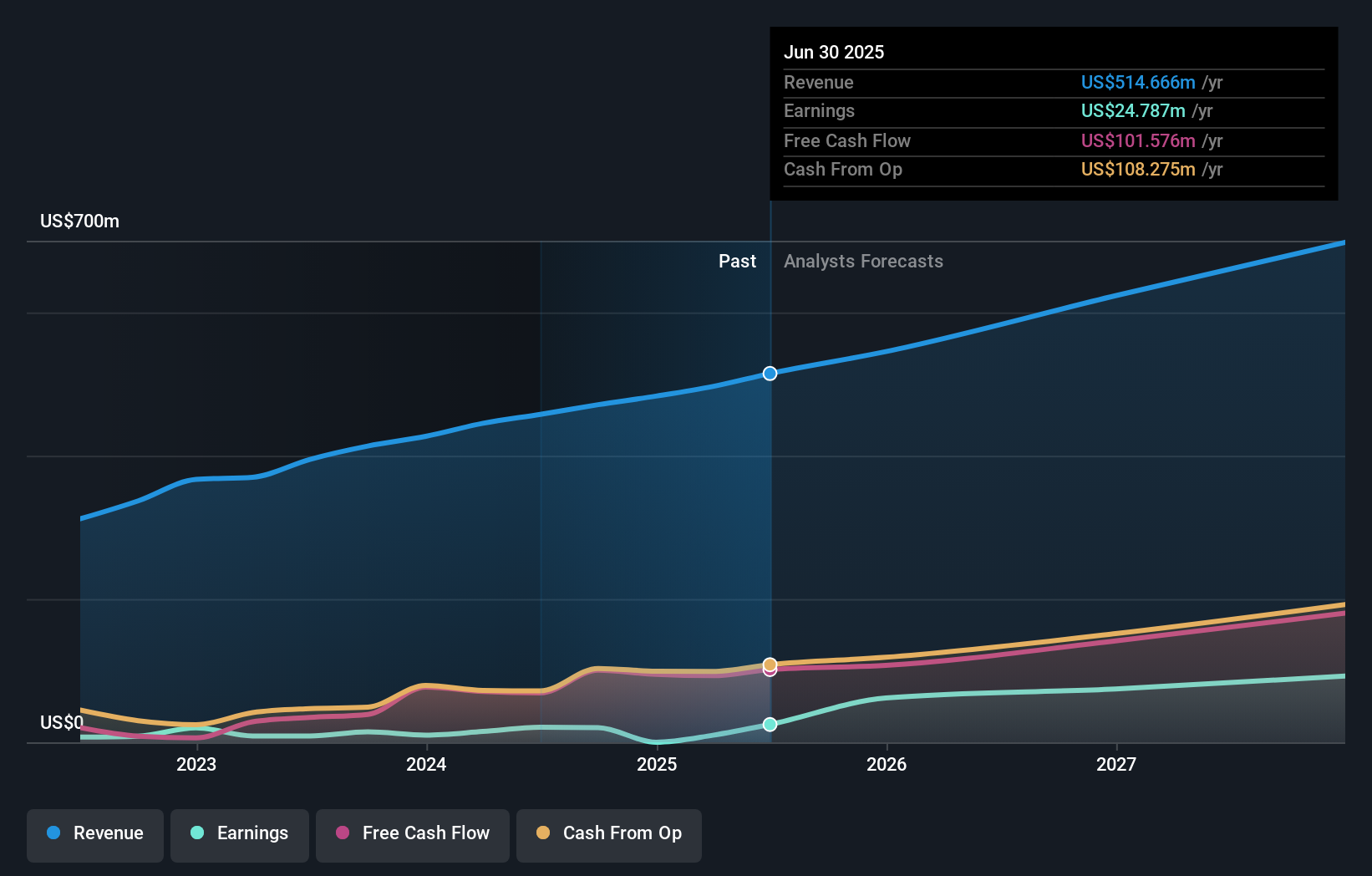

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$4.38 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software for supply chain operations, reporting $457.72 million in the Software & Programming segment. The company operates across multiple regions including the United States, Europe, Asia, and Canada.

Kinaxis has demonstrated a robust growth trajectory, with earnings expected to grow at 48.02% annually, outpacing the broader Canadian market’s 15.5%. Recent Q2 2024 results showed sales rising to $118.28M from $105.77M a year ago, and net income improving to $3.43M from a net loss of $2.54M previously. The company’s R&D expenses underscore its commitment to innovation; investments in AI-powered platforms like Maestro are pivotal for future scalability and efficiency in supply chain management.

Taking Advantage

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com