Shopping

Canada Introduces Temporary GST Tax Break To Ease Holiday Shopping

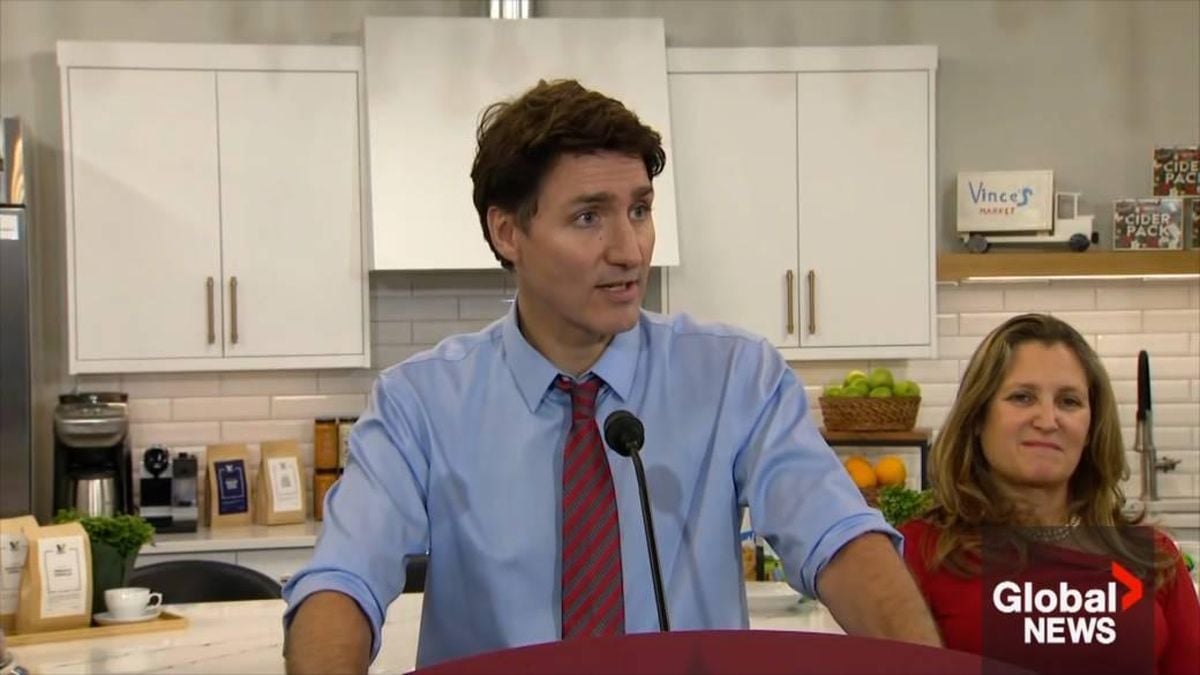

Canada is giving its citizens some relief from rising costs with a temporary GST/HST holiday set to begin on December 14, 2024. Prime Minister Justin Trudeau announced this measure as part of efforts to alleviate financial stress during the holiday shopping season, which is often marked by increased consumer spending. The holiday tax break is not just another political maneuver; it’s meant to help Canadians make their money stretch amid surging food prices and inflation pressures.

The announcement has sparked conversations—some approving, others skeptical. With the rapid increase of general living costs having impacted many households, the timing seems right for this initiative. The federal goods and services tax (GST) of 5% will be waived on various products until February 15, covering essentials like groceries, children’s clothing, and books, among other items. This breaks down to some significant savings for families planning to stock up for the winter.

For example, families purchasing groceries worth about $2,000 can expect savings of around $100 purely from the GST reduction. If they live in provinces where the HST applies (which combines federal and provincial taxes), those residents could save as much as $260 over the same period. The provinces affected include Ontario, New Brunswick, and Newfoundland and Labrador, to name just a few. These added savings are particularly important as food prices remain stubbornly elevated across the country.

Despite the well-meaning intentions behind this temporary tax break, it hasn’t been without criticism. Observers have pointed out the irony of the situation; most groceries are already exempt from GST, as clarified by community notes on social media. This has led to some ridicule directed at the Prime Minister, with many Twitter users expressing disbelief at the apparent lack of awareness surrounding the existing tax exemptions on basic grocery items. A user quipped, “Somebody forgot to tell Trudeau…” highlighting the disconnect felt by some citizens.

Critics argue this tax holiday may not provide the intended relief to Canada’s most vulnerable families. Dr. Sylvain Charlebois, food policy expert and senior director at Dalhousie University’s Agri-Food Analytics Lab, dubbed the initiative “a band-aid fix.” He cautioned against the risks of opportunistic pricing, which occurs when retailers increase prices to offset perceived losses during tax holidays. When the taxes return after the two-month break, consumers could find themselves facing even higher prices.

Charlebois notes, “Retailers may try to capture the five percent by increasing prices. You’d see tax applied not just on taxable products, but non-taxable ones as well. Prices go up across the board, and we’ve seen this trend over recent years.” His proposal for sustainable change suggests eliminating taxes on food altogether instead of employing temporary measures, which could lead to uncertainty and higher prices long-term.

The economic commentary doesn’t stop there. Analysts from the 2025 Canada’s Food Price Report predict food prices will continue to escalate, with staples like meat set to rise by as much as six percent. This increasing food cost framework only emphasizes the struggles many families face—particularly those utilizing food banks. A recent report noted nearly 2 million visits to food banks across Canada just last March.

These numbers paint a concerning picture of food insecurity, affecting nearly 22.9% of Canadian households. With the GST holiday offering negligible savings for families prioritizing basic needs, many critics are questioning whether temporary tax relief could stem the tide of rising prices or simply contribute to inflationary pressures.

Compounding the issues of food insecurity are rising operational costs incurred by retailers. Recycling fees intended to alleviate waste management burdens often trickle down to consumers—the very households the government aims to help through the tax exemptions. With logistics challenges persisting due to labor shortages and climate-related factors, lasting relief seems like it might remain out of reach for many.

The Retail Council of Canada maintains the belief the government’s approach is sound, asserting customers will benefit directly at the checkout. The council noted, “The tax break is automatic on qualifying items so consumers shouldn’t have to worry about missing out on any savings.” Customers can expect savings even on deliveries as long as they align with the taxable items set for the break.

Needless to say, this conversation surrounding Canada’s GST/HST holiday tax break is far from over. Skeptics and supporters alike will be watching to see how the government handles the aftereffects of this measure as prices fluctuate and the realities of everyday finances for Canadians continue to evolve. Will the temporary relief provide the support families need? Or are we setting ourselves up for exacerbated challenges down the line?

The government’s call to action is clear: Canadians need assistance now. Yet as temporary tax holidays frequently arise, the question is whether such measures truly offer long-lasting progress or merely mask underlying economic issues with convenient, albeit short-lived, policies. Moving forward, Canada certainly has lessons to learn on how to best support its families amid challenging economic times.