Jobs

US & Canadian jobs reports in focus – United States – English

Written by Convera’s Market Insights team

Dollar down as focus shifts to labor market

Boris Kovacevic – Global Macro Strategist

Yesterday’s trading session was heavily dominated by broad dollar weakness as the currency fell against all G10 peers. Investors are preparing for the most important global macro release of the month, the US non-farm payrolls report coming out today. Traders are hedging their bets against the figured undershooting expectations. The consensus is expecting a 200k job gain in November, after only 12k jobs were created the month prior.

Jerome Powell’s speech on Wednesday did little to nothing to budge Fed easing bets as options continue to place a 70% probability on a December rate cut. However, equity markets dropped on Thursday after the S&P 500 hit its 56th record this year due to jobless claims rising to a one-month high. The labor market remains the dominant force shaping market pricing and the US job report will give investors a clearer picture of the employment situation.

The US dollar is currently on track for a second consecutive negative week after the Greenback appreciated eight weeks in a row. The same goes for the two-year Treasury yield, which has fallen from 4.38% to 4.15% in the last two weeks.

Downtrend intact below $1.06

George Vessey – Lead FX Strategist

European equity markets are poised for a lower open today, as political turmoil in France dampened market sentiment. The euro is back on the defensive as traders remain wary about the European political backdrop, the diverging policy paths between the ECB and Fed, and anticipation of higher tariffs, which could further undermine the Eurozone economy.

This morning, data showed Germany’s industrial slump continued in October. Industrial production fell by 1% m/m, missing expectations of a 1% rebound and following a downwardly revised 2% decline in September, increasing the risk of a winter recession in Europe’s largest economy. Investors are awaiting the third reading of Eurozone GDP for the third quarter, though this shouldn’t be market moving. Next week, the ECB is set to cut rates for the fourth time this year. Unlike the previous three cuts though, the size of next week’s rate cut is not given as the deteriorating growth outlook and inflation at target, has opened discussions of a 50 basis point cut.

EUR/USD is flat on the week, having rebounded from below $1.05 largely as a result of broad-based dollar weakness. The downtrend remains intact below the $1.06 handle so this week’s close could be crucial. Against the pound, the euro continues to struggle, with GBP/EUR looking to hold above €1.20 for a third week running. In the FX options space, the price for protection against swings in the common currency on short term tenures are near their highest since March 2023.

Eying key moving average

George Vessey – Lead FX Strategist

Three days of gains on the trot for the pound versus the US dollar and over 2% higher than its recent low of just under $1.25, has GBP/USD trading around 50 pips shy of the $1.28 handle. We called this level at the start of the week given the gravitational pull of the 200-week moving average located at $1.2820. A weekly close above it will call the multi-month downtrend into question.

A weak US payrolls print today could be that catalyst. On the domestic front, the November Decision Maker Panel shows rising general inflation expectations in the UK, firms boosting their own planned price growth and stubbornly strong wage gains. This is a notable turn from the downtrend in those indicators in the past 18 months and thus the Bank of England (BoE) can afford to cut interest rates only gradually given these signals of continued inflation persistence. This has arguably limited sterling’s downside versus the US dollar since the election due to favourable UK rate/yield differentials making the pound more attractive. However, GBP/USD is currently trading at a discount to the UK-US 2-year yield spread. Instead, the pair is being driven by US dynamics as evidenced by its strong correlation with the pricing of Fed policy expectations.

Although the international backdrop could still evolve in many different ways, the return of a more-bullish GBP/USD outlook will require improved UK economic data prints and weaker US data prints.

JPY most volatile G10 currency of late

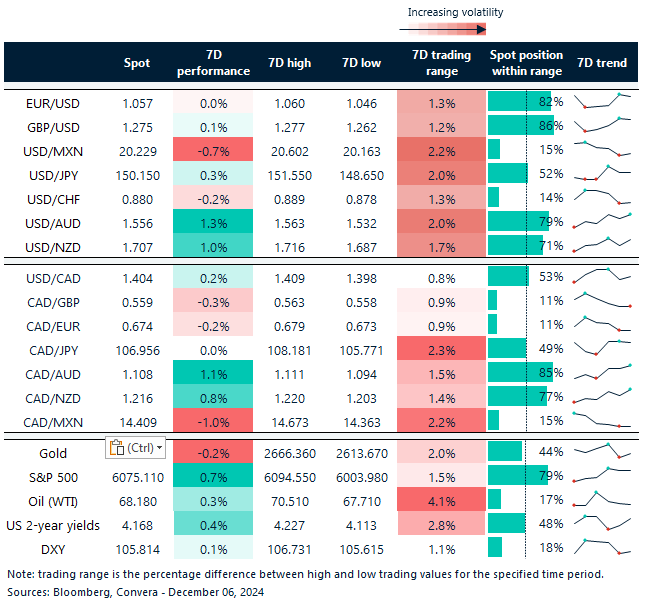

Table: 7-day currency trends and trading ranges

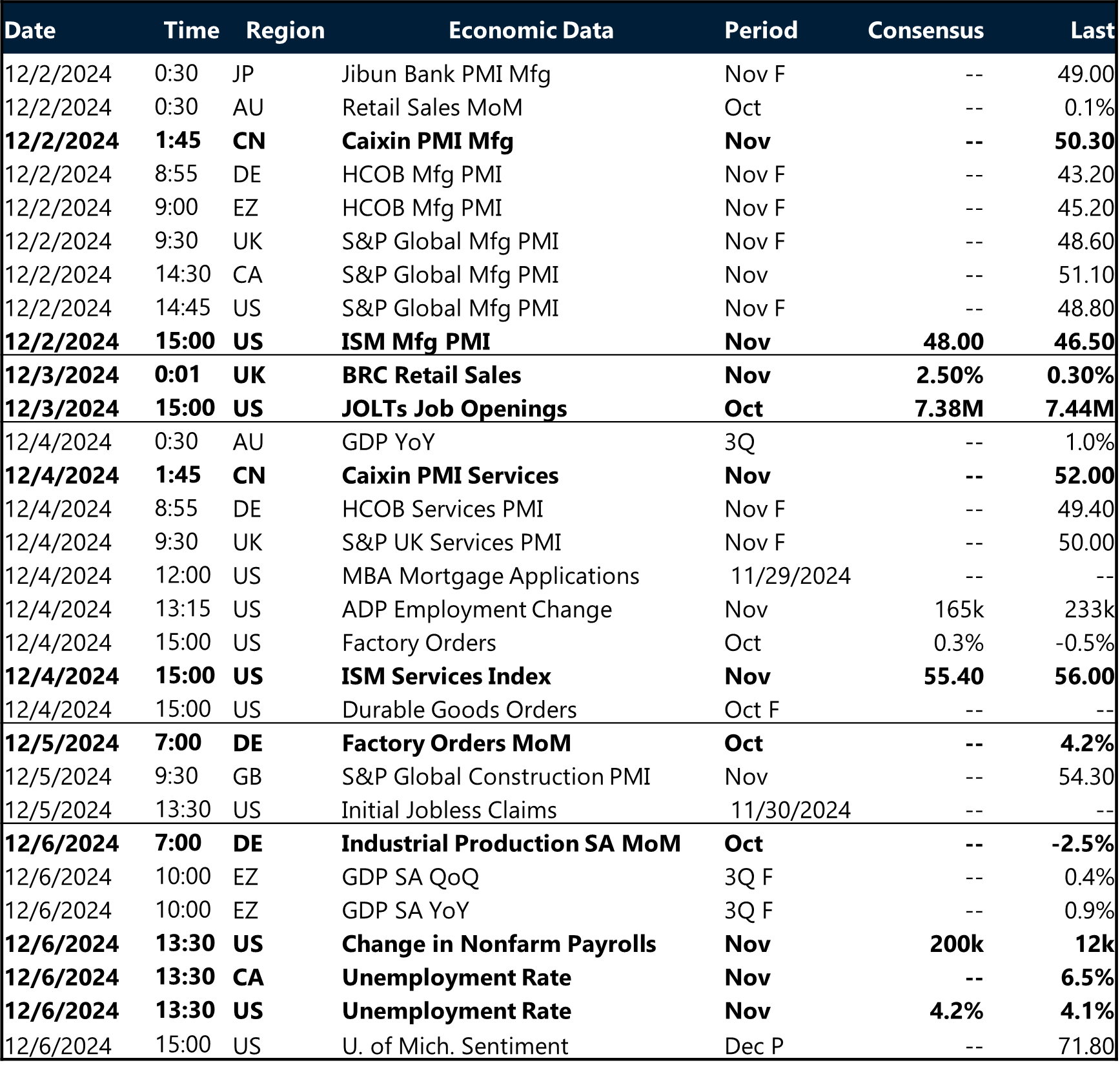

Key global risk events

Calendar: December 2-6

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.