Shopping

CICC raises concerns about federal government’s GST holiday plans

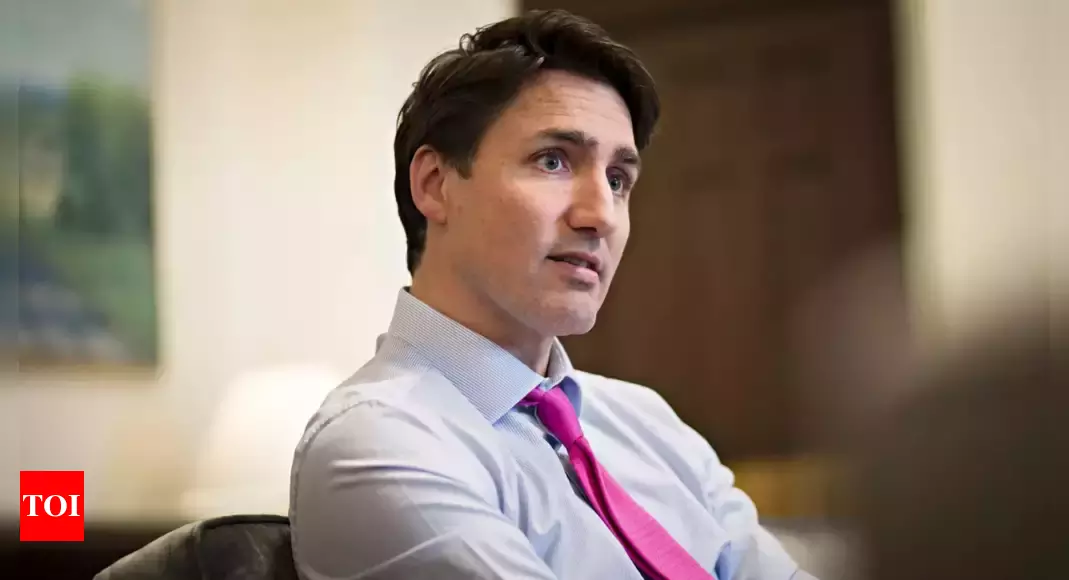

Photo: Adrian Wyld, The Canadian Press

The Convenience Industry Council of Canada (CICC) has responded to the news of the federal government’s announced plans on Thursday to lift temporarily the federal sales tax across a broad range of items just in time for the approaching Christmas holiday.

In a statement released to the press today, the CICC says while many of the items that will be eligible for GST exemption are sold in convenience stores, “we have outstanding questions about application to certain products including energy drinks. The response from business groups has been mixed, with Canadian Federation of Independent Business pointing to product applicability and implementation confusion. Restaurants Canada and Retail Council of Canada have supported the proposal.”

The GST break would begin Dec. 14 and end Feb. 15. The Liberals say it will apply to a number of items including children’s clothing and shoes, toys, diapers, restaurant meals and beverage alcohol including wine, beer, cider, and coolers under 7% are included. It also applies to Christmas trees — both natural and artificial — along with a variety of snack foods and beverages, and video game consoles.

The government is proposing (need legislation passed to implement) that the GST/HST (Ontario, Newfoundland and Labrador, Nova Scotia and New Brunswick are harmonized) be fully and temporarily relieved on most food and beverage products (including snacks, candy, gum) and other items that convenience stores across Canada sell, such as newspapers, and magazines. While the list of products to fall under the GST holiday is long, it does not appear that energy drinks is on the list.

Canadians who worked in 2023 and earned less than $150,000 would also receive a $250 cheque in the spring. The measures come as an inflation-driven affordability crunch has left voters unhappy with the Trudeau government.

“Our government can’t set prices at the checkout, but we can put more money in people’s pockets,” Prime Minister Justin Trudeau said at a press conference in Toronto alongside Finance Minister Chrystia Freeland. “The working Canadians rebate of $250 which will be sent to people in April, is going to give people that relief they need, and the tax break over the next two months is going to help on the costs of everything as we approach the holidays, as we get into the new year.”

“CICC’s viewpoint is that, while customer relief is helpful, the temporary nature of a GST holiday doesn’t meaningfully address affordability for customers and for our stores. It will also be extremely laborious for our retailers to implement. It is the antithesis of red tape reduction.”

The measures come as an inflation-driven affordability crunch has left voters unhappy with the Trudeau government. High inflation has also put pressure on the Liberals to avoid introducing measures that would stimulate spending and fuel price growth.

However, the prime minister dismissed the idea that this move could raise inflation again, noting that price growth and interest rates are down.

“It allows us to make sure that we are putting money in people’s pockets in a way that is not going to stimulate inflation, but is going to help them make ends meet and continue our economic growth,” Trudeau said.

READ: Federal government plans to give $250 cheques to millions of Canadians, cut GST