Tech

Exploring High Growth Canadian Tech Stocks In October 2024

As we enter the fourth quarter of 2024, Canadian markets have experienced a mix of strong performance and volatility, with the TSX rising over 14% in the first three quarters despite uncertainties surrounding geopolitical tensions and economic indicators. In this dynamic environment, high-growth tech stocks in Canada are drawing attention for their potential to capitalize on solid economic fundamentals and evolving market conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.22% | 179.27% | ★★★★☆☆ |

| BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., along with its subsidiaries, functions as an entertainment and media company both in Canada and internationally, with a market cap of CA$657.87 million.

Operations: Cineplex generates revenue primarily from Film Entertainment and Content, contributing CA$1.05 billion, followed by Location-Based Entertainment at CA$132.08 million and Media at CA$120.16 million. The company’s operations span both Canada and international markets, focusing on diverse entertainment offerings that include cinema exhibition, digital commerce, and amusement gaming solutions.

Cineplex’s trajectory in the Canadian tech landscape, while marked by recent financial turbulence, shows a nuanced potential for recovery and growth. Despite reporting a significant net loss of CAD 21.44 million in Q2 2024 and a downturn in revenues to CAD 277.34 million from CAD 367.92 million year-over-year, the company has initiated an aggressive share repurchase program, planning to buy back up to 6.3 million shares by August 2025. This move could signal confidence from management in the company’s future prospects, particularly as earnings are forecasted to surge by an impressive 179.27% annually over the next three years. Additionally, Cineplex’s revenue growth is projected at a steady rate of 7.2% per year, slightly outpacing the broader Canadian market forecast of 7%.

Simply Wall St Growth Rating: ★★★★☆☆

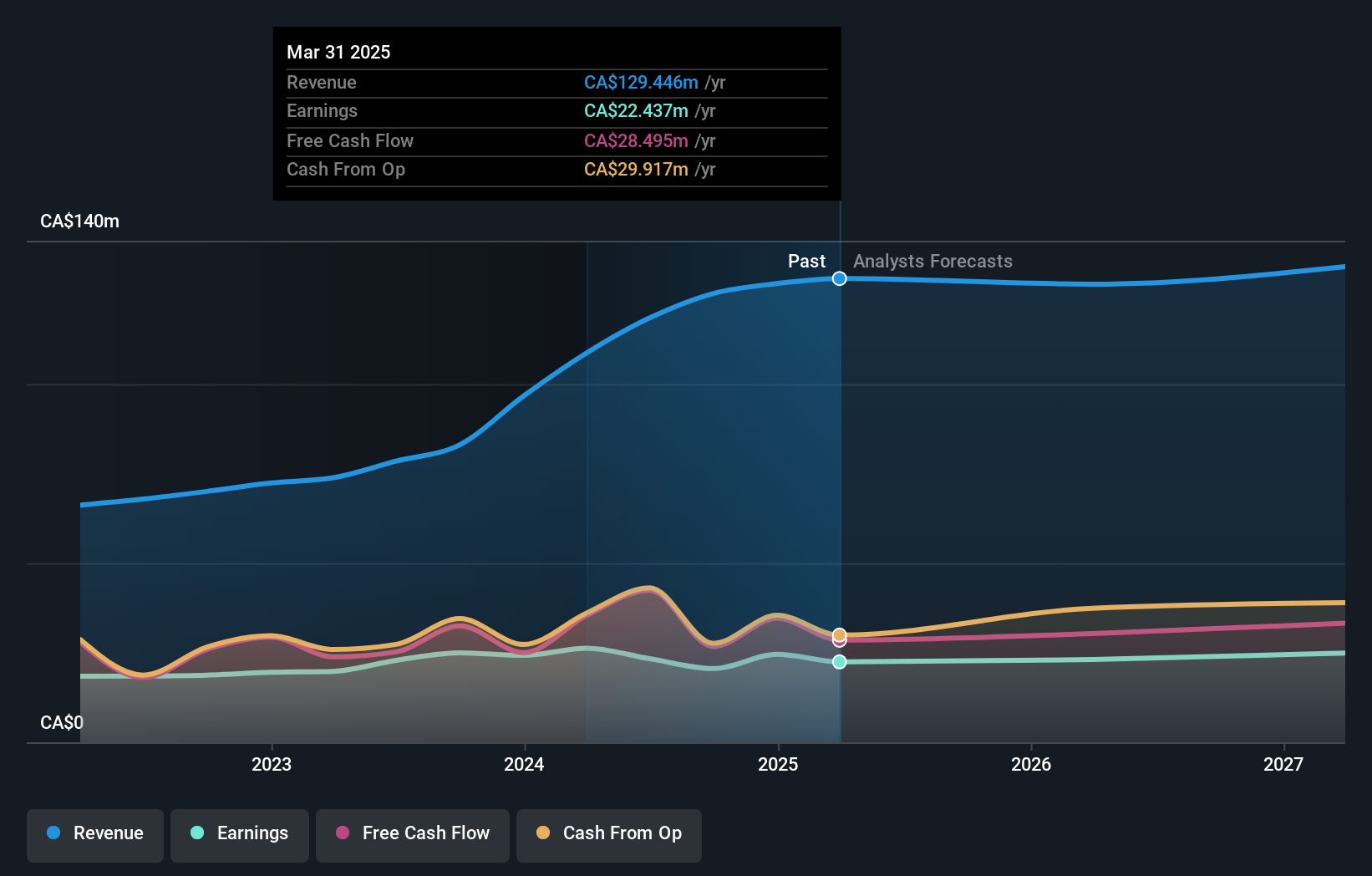

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that focuses on developing and licensing reservoir simulation and seismic interpretation software, with a market capitalization of CA$979.01 million.

Operations: The company generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million.

Amidst a dynamic shift towards sustainable energy solutions, Computer Modelling Group Ltd. (CMG) has strategically positioned itself with the launch of Focus CCS, enhancing its portfolio in carbon capture and storage (CCS). This innovation not only accelerates CO2 storage site selection but also ensures long-term environmental compliance, pivotal as industries globally pivot towards net-zero targets. Financially, CMG exhibits robust growth prospects with an expected revenue increase of 11.5% annually and earnings anticipated to surge by 24.6% per year, outpacing the broader Canadian market’s forecasted growth rates. Moreover, the firm’s recent addition to the S&P Global BMI Index underscores its expanding influence within the tech sector, further solidified by a significant project collaboration for CO2 storage in the Norwegian North Sea set to commence in 2029.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada, with a market capitalization of CA$4.50 billion.

Operations: Kinaxis generates revenue primarily from its Software & Programming segment, totaling $457.72 million. The company focuses on delivering cloud-based solutions for supply chain management across multiple regions, including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in supply chain management software, recently showcased its robust growth trajectory and strategic client acquisitions. With a notable 14.7% expected annual revenue increase and an impressive 48.5% forecasted earnings growth rate per year, Kinaxis is outpacing the broader Canadian tech sector’s expansion rates. The company’s dedication to R&D has been pivotal; last year alone, R&D expenses constituted a significant portion of revenue, underscoring their commitment to innovation in AI-driven supply chain solutions. This focus on continuous improvement and expansion into new market segments like life sciences and auto manufacturing with clients such as ONO Pharmaceutical and Mahindra & Mahindra Ltd., respectively, positions Kinaxis favorably for sustained influence within high-growth industries.

Turning Ideas Into Actions

- Click here to access our complete index of 24 TSX High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com