Tech

Exploring Constellation Software And Two Other High Growth Canadian Tech Stocks

In the last week, the Canadian market has been flat, but it is up 19% over the past year with earnings forecast to grow by 15% annually. In this promising environment, identifying high growth tech stocks such as Constellation Software can be crucial for investors looking to capitalize on robust market conditions.

Top 10 High Growth Tech Companies In Canada

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Docebo |

14.71% |

33.96% |

★★★★★☆ |

|

HIVE Digital Technologies |

48.71% |

94.27% |

★★★★★☆ |

|

Constellation Software |

16.17% |

23.55% |

★★★★★☆ |

|

GameSquare Holdings |

38.08% |

86.64% |

★★★★★☆ |

|

Blackline Safety |

22.38% |

162.50% |

★★★★★☆ |

|

Medicenna Therapeutics |

62.37% |

57.20% |

★★★★★☆ |

|

Sabio Holdings |

12.97% |

122.50% |

★★★★☆☆ |

|

BlackBerry |

20.61% |

76.74% |

★★★★★☆ |

|

Cineplex |

7.33% |

179.27% |

★★★★☆☆ |

|

Alpha Cognition |

62.98% |

69.54% |

★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

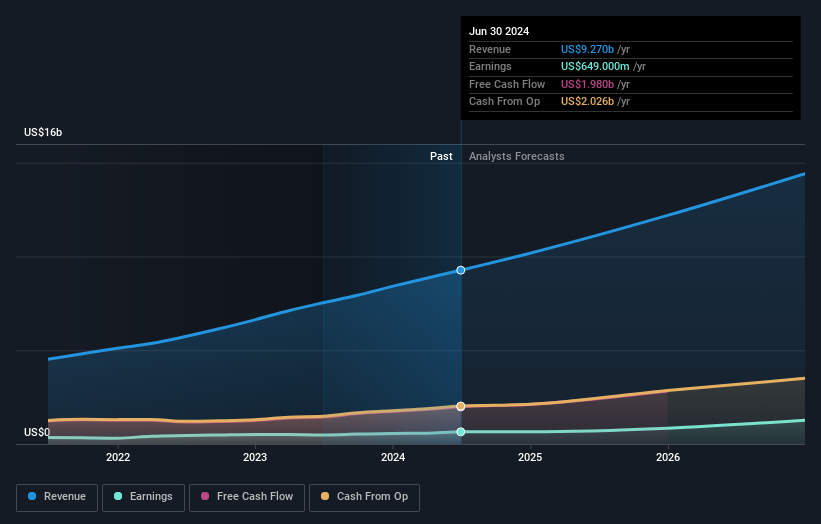

Overview: Constellation Software Inc., along with its subsidiaries, acquires, develops, and oversees vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$92.72 billion.

Operations: Constellation Software generates revenue primarily through its software and programming segment, which accounts for CA$9.27 billion. The company focuses on acquiring, building, and managing vertical market software businesses across various regions globally.

Amid a robust financial backdrop, Constellation Software’s recent performance underscores its strategic positioning within high-growth tech sectors in Canada. With a 16.2% annual revenue growth rate outpacing the Canadian market average of 6.9%, and an impressive 23.6% expected annual profit growth exceeding the market’s 14.9%, Constellation is navigating its expansion adeptly. The launch of Omegro, uniting diverse software entities under a global umbrella, not only broadens operational scope but also enhances service delivery across international markets, promising sustained growth and innovation in its niche segments. This strategic expansion is complemented by solid financials; Q2 reports show revenues soaring to USD 2.47 billion from USD 2.04 billion year-over-year, with net income also up significantly at USD 177 million compared to last year’s USD 103 million. These figures reflect not just resilience but also an aggressive push towards leveraging technological advancements and market position to secure long-term value for stakeholders while continuously adapting to dynamic market demands.

Simply Wall St Growth Rating: ★★★★★☆

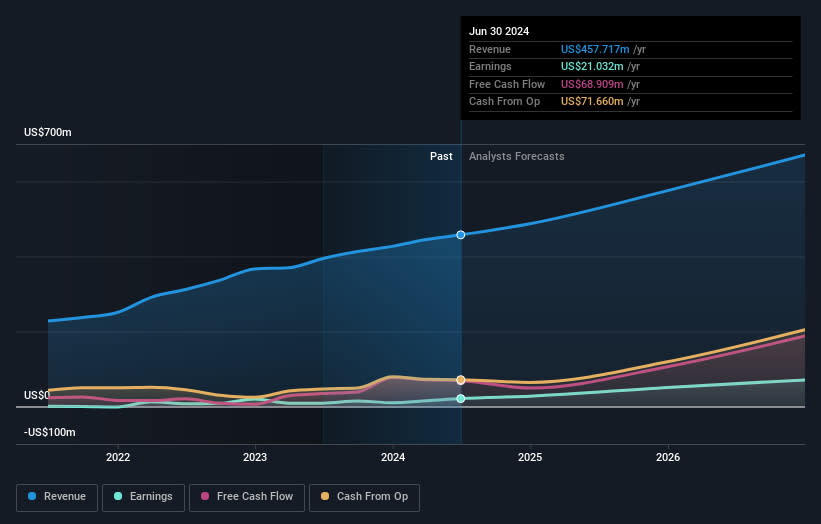

Overview: Docebo Inc. operates as a learning management software company that provides an artificial intelligence (AI)-powered learning platform in North America and internationally, with a market cap of CA$1.91 billion.

Operations: Docebo generates revenue primarily from its educational software segment, which brought in $200.24 million. The company leverages artificial intelligence to enhance its learning management platform, serving clients both in North America and internationally.

Docebo, a player in the Canadian tech landscape, is making notable strides with its recent executive leadership changes and robust financial performance. The company’s revenue is expected to grow by 14.7% annually, outpacing the Canadian market average of 6.9%. This growth is underpinned by a significant increase in earnings, projected at 34% per year, which starkly contrasts with the broader market’s expectation of 14.9%. Moreover, Docebo has demonstrated a remarkable turnaround from last year’s net loss to this year’s net income of USD 4.7 million in Q2 alone—a testament to its operational efficiency and strategic direction under new CEO Alessio Artuffo. With R&D expenses consistently fueling innovation and product development—critical for staying ahead in competitive tech sectors—Docebo’s commitment to reinvestment in technology underscores its potential for sustained growth and industry leadership.

Simply Wall St Growth Rating: ★★★★☆☆

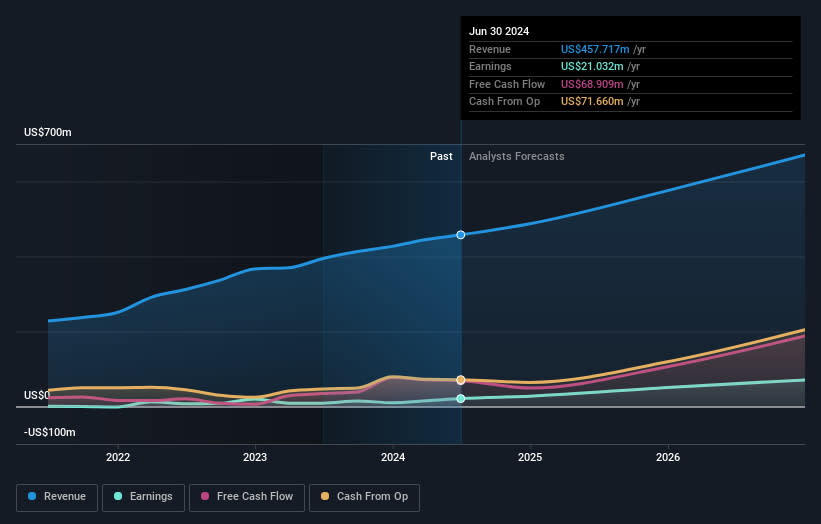

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.59 billion.

Operations: Kinaxis Inc. generates revenue primarily through its cloud-based subscription software, specifically within the Software & Programming segment, amounting to $457.72 million. The company operates across multiple regions including the United States, Europe, Asia, and Canada.

Amidst a flurry of executive changes and shareholder activism, Kinaxis stands out with its robust R&D investment, which has consistently fueled innovation in supply chain management software. The company’s dedication to R&D is evident as it spent 14.9% of its revenue on research and development activities last year, underscoring its commitment to maintaining a competitive edge in AI-driven supply chain solutions. Despite recent pressures for strategic reassessment from investors like Irenic Capital Management and Daventry Group, Kinaxis reported a notable earnings growth of 48.9% this past year, signaling strong operational resilience and market demand for its offerings. As the company navigates leadership transitions and explores strategic options, these solid financials coupled with deep market penetration suggest promising prospects for sustained growth within the high-stakes tech landscape of Canada.

Taking Advantage

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CSU TSX:DCBO and TSX:KXS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com