Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Tech

Canadian tech founder tries to fulfill ‘Berkshire 2.0’ promise

Wilkinson is personally worth about $350 million adding together his roughly two-thirds stake in Tiny with real estate and other assets

Article content

Canadian entrepreneur Andrew Wilkinson’s early decision to ditch a career as a journalist and teach himself web design has proved lucrative, making him the majority owner of a technology investment firm worth more than US$300 million.

But he’s still got a taste for an eye-catching headline. At the age of 38, he’s written a memoir, called Never Enough: From Barista to Billionaire.

Advertisement 2

Article content

The book’s jacket boasts an endorsement from hedge fund billionaire Bill Ackman, whom Wilkinson met after spending US$57,700 on a charity auctioned-lunch. The autobiography is peppered with the wisdom of Warren Buffett and the late Charlie Munger — men Wilkinson idolizes to the point of selling statuettes of their heads.

But they have a couple of things that Wilkinson still lacks: legions of loyal investors, and billion-dollar fortunes.

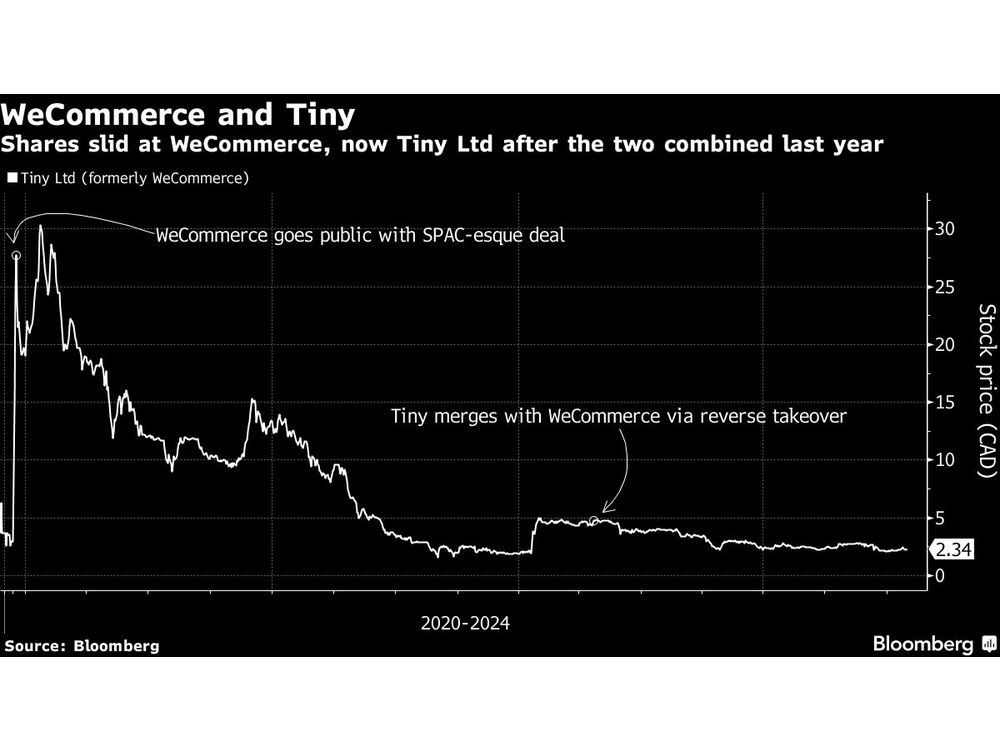

Wilkinson was “briefly a billionaire” in Canadian dollar terms, according to a spokesperson for Tiny Ltd., the publicly traded firm that makes up most of Wilkinson’s net worth. That was in 2021, when ultra-low interest rates fuelled an epic market run in speculative investments. The shares have slumped after Tiny went public via a combination with a separate Wilkinson vehicle, WeCommerce.

But Wilkinson vows a comeback and an effort to turn Tiny into a “multibillion-dollar business” — not because he wants to amass more wealth, but because he wants to follow his role models and give it away.

Wilkinson found success in his early 20s with MetaLab, selling web design services he taught himself while working in a cafe. He followed that with Pixel Union, which sold themes and apps for e-commerce users of Shopify Inc., tapping into the growth of what’s now Canada’s most valuable technology company.

Article content

Advertisement 3

Article content

Today, Wilkinson is personally worth about $350 million, a company spokesperson said, adding together his roughly two-thirds stake in Tiny with real estate, private equity and venture assets.

After he paid off his mom’s mortgage and the novelty of luxury cars wore off, Wilkinson says, he started to experience an “existential crisis” over how to use his money. So he called Ackman for advice.

The Pershing Square founder, who’d invested in Wilkinson’s venture WeCommerce, urged him to sign the Giving Pledge — the oath created by Bill Gates, Melinda French Gates and Buffett — to encourage the wealthy to give away their fortunes. Ackman then set up a call for Wilkinson with Buffett himself, who echoed the sentiment. A representative for Ackman didn’t respond to requests for comment.

Retail money

Today, Tiny has acquired stakes in more than 30 companies across e-commerce, marketing and digital services. They include WeCommerce — a suite of services for merchants to build and grow online stores — and Wilkinson’s original business MetaLab, which created “much of the early design DNA” of Slack, according to his account.

Advertisement 4

Article content

Others are niche businesses. Last year, the firm bought most of Letterboxd Ltd., a site where movie buffs trade recommendations. In 2021, it acquired control of Aeropress Inc., which sells coffee-makers; Wilkinson says they’ve increased its online sales sixfold. It also has a yerba mate beverage in partnership with science podcast guru Andrew Huberman.

Despite the stock market thrashing, Wilkinson says he’s relaxed. What happened when much of his paper wealth was vaporized? “Absolutely nothing,” he writes in the book — except smaller numbers on reports from his accountants.

Minority shareholders seem less Zen.

Tiny’s share price fell 16 per cent on a single day in June after filings showed Wilkinson planned to dispose of as many as 3.1 million shares, with an undisclosed amount going to donations, and the company announced that he and co-founder Chris Sparling would step down as co-chief executives to focus on board roles. Speculation about Wilkinson’s commitment to the business percolated on social media.

The filings, Wilkinson says, were simply him “following through and starting to shovel money over to my foundation” and gifting stock to early employees, a year after signing the Giving Pledge, he said in an interview at his office in Victoria, B.C. Donations and gifts will probably be about 70 per cent of the disposals, he said, with some set aside for private sales to pay for expenses, including a divorce.

Advertisement 5

Article content

“It’s driven by retail money,” Canaccord Genuity analyst Robert Young said of the stock, adding that Tiny’s scarce free floating shares are thinly traded, which can make them volatile.

Tiny’s reported revenue has doubled since 2020 on a pro forma basis, according to a company presentation, and it recently attracted money from a UK investment firm, but its performance “hasn’t been where we would’ve expected it,” said Young, who also noted its debt, which stands at about $130 million. Wilkinson told Bloomberg he wants to pay this down.

Wilkinson and Sparling talk about making long-term bets. To make more deals, though, it would help to have a more valuable stock.

“Wilkinson is extremely adept at marketing himself on social media, and marketing Tiny,” Young said in a phone interview. “It just doesn’t have the options to go out and be acquisitive, which is the stated purpose.”

Although Wilkinson is content he has enough money, he said this doesn’t mean he’s less motivated to build his company. “I also have a duty to our shareholders, employees, and the non-profits we fund, and I take that seriously.”

Advertisement 6

Article content

Tiny’s new chief executive, Jordan Taub, previously worked under Mark Leonard at Constellation Software Inc., a Toronto-listed software holding company that has become a cult stock in Canada. Wilkinson spoke admiringly of Constellation’s empire of niche software companies — and hiring Taub is another way he can take lessons from a top global investor.

Taub said by email that he’s focused on boosting cash flow with organic growth, controlling costs, and building value in a “disciplined” way.

In another kind of reset, Wilkinson and Sparling are also selling the company’s luxury house-turned-office in Victoria, tempted by the idea of getting back to basics. When they move out, they’ll have to rehouse the equipment for Wilkinson’s prolific podcasting, and their collection of Berkshire Hathaway iconography, including a framed chart of its stock performance, a photo of them with Munger, and a Berkshire version of Monopoly.

According to Wilkinson’s book, Tiny actually came close to a merger with Munger’s Daily Journal Corp. Ultimately it didn’t happen, and Wilkinson introduced Munger to a fellow Victoria resident, Steven Myhill-Jones, who is now Daily Journal’s chief executive and chair. Munger “always spoke highly” of the Tiny co-founders, Myhill-Jones said by email.

Recommended from Editorial

But their decision to play up this association — like a Wilkinson blog post about “Building Berkshire 2.0” — is a double-edged sword that can invite an unflattering comparison with two of the most successful investors of all time.

“We’re not saying we’re the next Warren Buffett and Charlie Munger,” Wilkinson said. “It just so happens that they have a lot of prophetic wisdom that we want to learn from.”

Article content